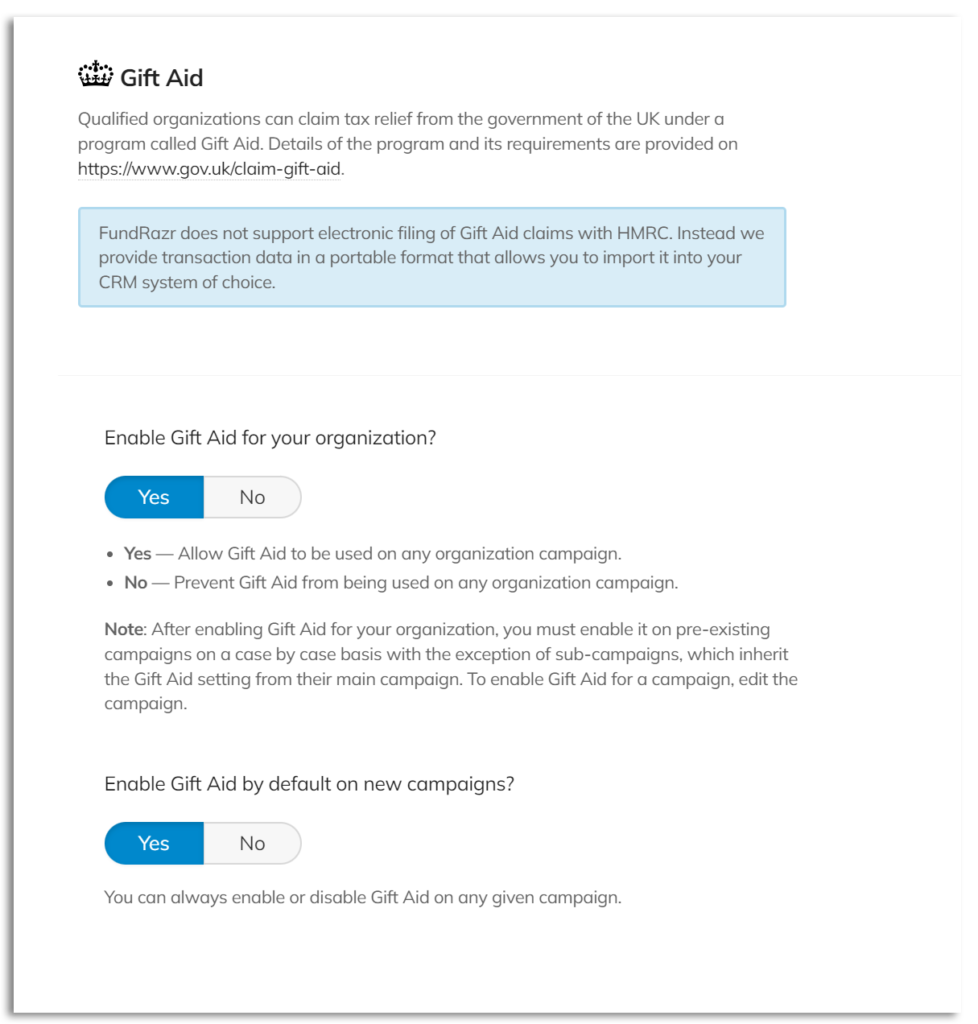

To apply Gift Aid to your campaigns (if your organization qualifies), you’ll set it up on your Organization profile, and it’ll apply to each campaign under your organization’s umbrella.

What is Gift Aid? #

Gift Aid is a UK government program that allows tax-effective donations to charities and community amateur sports clubs (CASCs). It enables eligible organizations to claim an additional 25p for every pound donated by UK taxpayers. It effectively increases the value of donations at no extra cost to the donor.

To qualify for Gift Aid, a donor must be a UK taxpayer and make a declaration when making a donation. The declaration confirms that the donor has paid or will pay an amount of Income Tax and/or Capital Gains Tax for the tax year that is at least equal to the amount of Gift Aid being claimed on their donations.

Gift Aid provides a significant financial boost to charitable organizations in the UK, helping them fund various projects and activities. It is an essential part of the UK’s philanthropic landscape. It encourages support for causes that donors care about while allowing charities to maximize the impact of each donation.

The rules and regulations can change over time, so we suggest checking the latest information on Gift Aid from official government sources or the relevant charity sector organizations if you’re unsure of anything.

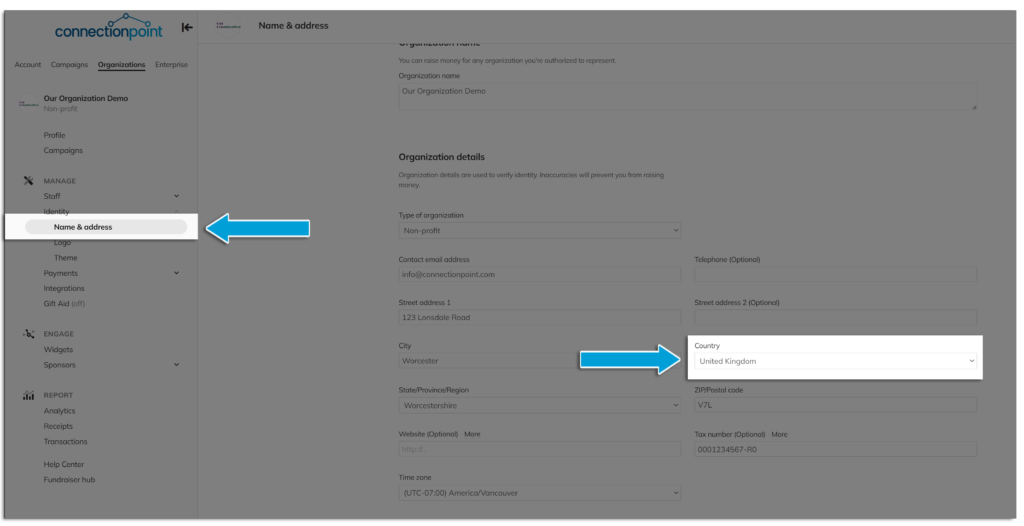

STEP 1—In your Organization profile, make sure your country is ‘United Kingdom’ under ‘Identity’ and ‘Name & address.’

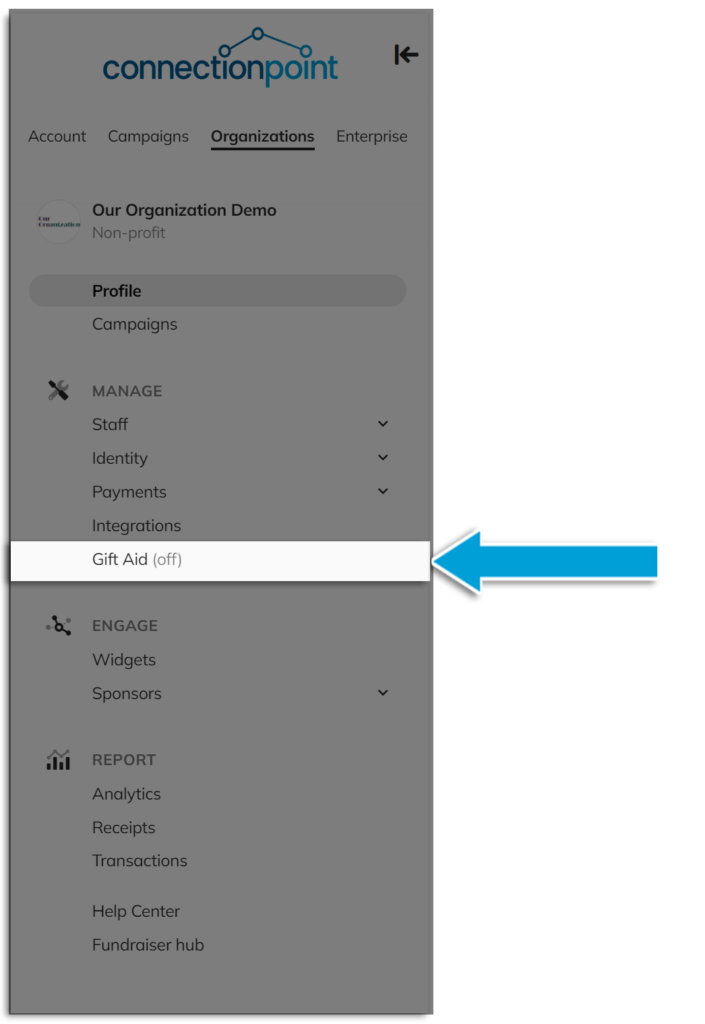

STEP 2 – Click ‘Gift aid’ in the navigation menu.

Remember, this will only appear if your country is listed as the United Kingdom.

STEP 3 – Toggle to ‘On,’ choose to enable by default on new campaigns under your organization, then Save.

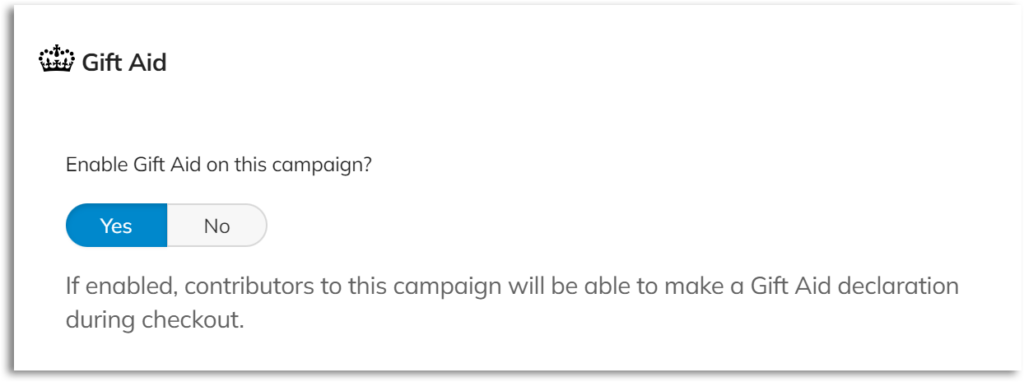

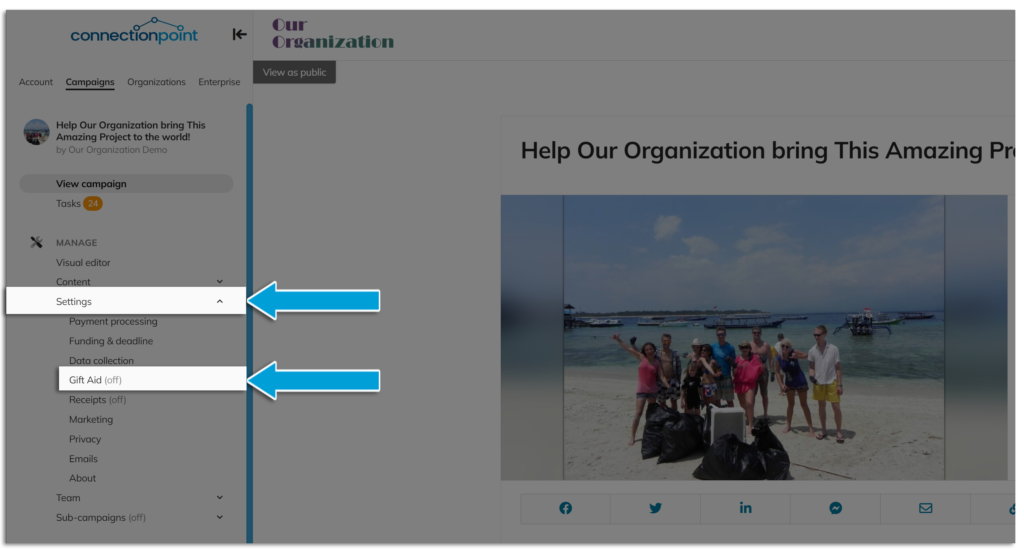

If you’d rather choose campaigns to apply Gift aid ad hoc to each campaign, go to the campaign in question and click ‘Settings’ then ‘Gift Aid.’

Toggle to ‘Yes’ then ‘Save.’